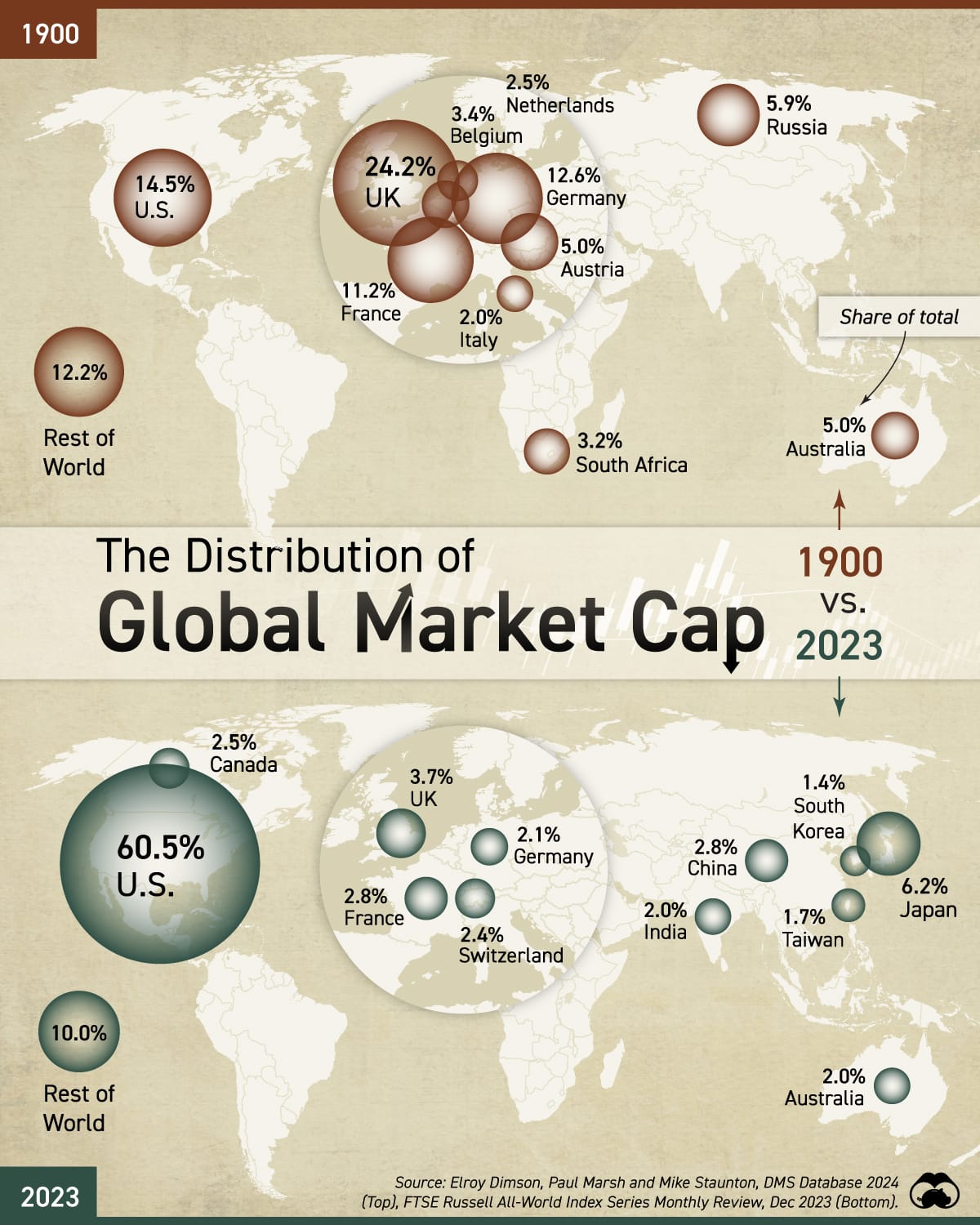

A century of change: the evolution of global market capitalisation

From empires to upstarts: Will history's wheel favour past giants or crown new contenders?

Over the past century, the landscape of global market capitalisation has undergone a dramatic transformation, reflecting major shifts in economic power, technological innovation, and geopolitical dynamics. While I'm no economic expert, this infographic does a neat job in showcasing the change. Tracing the evolution from a European-dominated financial world in 1900 to the current U.S.-centric market of 2023.

Economic Growth Dynamics

The global economic landscape of 1900 differed starkly from today's. The United Kingdom, leveraging its vast colonial empire and industrial prowess, dominated with 24.2% of global market capitalisation. The United States, though significant, held just 14.5%. However, their trajectories would soon dramatically diverge.

Rapid industrialisation propelled the U.S. to surpass the UK by 1901, heralding a new financial era. The post-World War II period saw unprecedented U.S. economic expansion, driven by technological innovation, robust consumer demand, and strategic global positioning. This growth culminated in the U.S. commanding 60.5% of global market capitalisation by 2023, cementing its economic dominance.

Concurrently, other nations experienced notable economic shifts. Japan's post-war economic miracle, fuelled by strategic industrial policies and technological advancements, saw its global market cap share soar to 40% by 1989. However, this meteoric rise was followed by a sharp decline after Japan's economic bubble burst in the early 1990s, illustrating the volatility of market dominance and the profound impact of economic policies.

Financial Market Development

The transformation of financial markets significantly reshaped global market cap distribution. The United States capitalised on its deep, liquid, and sophisticated markets, attracting both domestic and international investors. By 2023, this advantage solidified the U.S. position at 60.5% of global market cap.

In contrast, European markets experienced relative decline. Once-dominant financial hubs like London, Paris, and Frankfurt saw their global shares diminish. The UK's market cap share fell dramatically from 24.2% in 1900 to 3.7% in 2023, due to slower economic growth, loss of colonial ties, and the rapid development of U.S. markets.

Emerging market exchanges, particularly in Asia, also altered the landscape. While individually smaller than the U.S., their collective impact grew significantly. China's share reached 2.8% by 2023, reflecting its economic reforms and rapid industrialisation. This shift underscores the evolving nature of global financial power and the rise of new economic centres.

Technological Advancements

Technological breakthroughs drove significant shifts in global market capitalisation, especially from the mid-20th century onward. The United States led this revolution, with Silicon Valley emerging as a global innovation hub.

The rise of tech giants like Apple, Microsoft, Amazon, and Google (Alphabet) not only boosted U.S. market capitalisation but also attracted substantial global investment. These companies, along with other tech sector leaders, dominated market indices and became some of history's most valuable corporations.

This tech-driven growth solidified the U.S.'s market position, contributing greatly to its 60.5% share of global market cap in 2023. The stark contrast with its 14.5% share in 1900 highlights how technological leadership shapes financial markets and global economic influence.

Geopolitical Changes

Geopolitical events significantly reshaped global markets. Two World Wars, the fall of European colonial empires, the Cold War, and emerging economic powers all altered the financial landscape massively and Europe suffered.

Post-World War II stability in the United States and Western Europe fostered sustained economic growth and market development in these regions while others lagged behind.

Political instability and challenging economic policies hindered progress. Russia exemplifies this: its 5.9% share of global market cap in 1900 diminished dramatically following the Russian Revolution, Soviet era, and post-Soviet transition challenges.

China's story contrasts sharply. Economic reforms initiated in the late 1970s propelled it to become the world's second-largest economy within 50 years. Yet, its 2.8% share of global market capitalisation in 2023 still lags behind its economic weight, reflecting the complexities of transitioning from a centrally planned to a market-oriented economy.

Regulatory Environments

The regulatory landscape significantly influenced market attractiveness to global investors. The United States benefited from a robust legal system and regulatory framework that generally provided a secure investment environment, contributing to its dominance in global equity markets.

Regulatory uncertainties in emerging markets often deterred international investments, impacting their market cap growth. Developed markets like the U.S., UK, and Japan maintained large market caps partly due to regulatory stability and transparency. However, improving regulatory regimes in emerging markets, particularly in Asia, are gradually levelling the playing field.

We stand at a crossroads. In 1900, industrial conglomerates, resource extraction companies, and banks dominated global finance. By 2023, U.S.-based technology firms had risen to unprecedented market values, reflecting broader economic shifts:

- Transition from manufacturing to services in developed economies

- Digital revolution and rise of the knowledge economy

- Increasing value of intellectual property and innovation

- Network effects and scalability of digital platforms

As we look to the future, several questions emerge:

- Can the U.S. maintain its market dominance despite massive debt?

- How will China's economic rise translate into global market capitalisation?

- Will countries like India, Brazil, or African nations see market cap shares match their economic growth?

- Can emerging technologies reshape the corporate landscape and market capitalisation distribution?

- How will aging populations in developed countries and surging populations in emerging markets impact investment flows and valuations?

Understanding these historical trends provides insights into potential future shifts. The coming decades may see new challengers emerge, driven by technological innovations, demographic shifts, or geopolitical realignments. The digital revolution, rise of fintech, changing demographics, and growing economic weight of emerging markets will reshape the global market capitalisation landscape.

Today's financial giants may become tomorrow's footnotes, while nascent markets could become future powerhouses.

This is of infinite importance because that is the world our children will inherit.

PS: Recommended Reading:

- Visual Capitalist. (2023). The $109 Trillion Global Stock Market in One Chart.

- McKinsey & Company. (2023). $118 Trillion and Counting: Taking Stock of the World's Capital Markets.

- SIFMA. (2023). Global Equity Markets Primer.

About Me:

I write 'cos words are fun. More about me here. Follow @hackrlife on X